Thursday, December 10, 2009

Blogging Hiatus

I will be taking a potentially extended hiatus from blogging. My youngest son (5 months) is having surgery today to correct an atrioventricular septal defect. Thanks for your thoughts and I hope to return in the new year.

SMC

Monday, November 30, 2009

Yikes! - Q3 Real GDP Growth = 0.4%

Real GDP growth for Q2 was revised up ever so slightly from -3.4 to -3.1.

With such slim growth, there is a good chance that Q3 may be revised into negative territory, indicating that the recession did not end in early Q3 as previously believed.

Tuesday, November 10, 2009

Exchange Rate Forecast

Barring extraordinary intervention by the Bank of Canada, I expect the loonie to continue a trajectory towards parity, with a strong possibility of eclipsing that mark in early 2010. The graph above sets out my baseline forecast for the quarterly average US/CAD exchange rate from Q4 09 – Q4 10. The forecast is presented with 50%, 70% and 90% confidence intervals to factor the daily volatility of exchange rates and uncertainty underlying the forecast. The confidence intervals were constructed using spreadsheets from the authors of this (recommended) paper.

Wednesday, November 4, 2009

Sunday, October 25, 2009

"Intervention" is just a fancy word for printing money

The Bank’s chief concern is that a high loonie presents a risk that inflation may not return to target in timely fashion. Under normal circumstances, the central bank would simply reduce interest rates to take some air out of the loonie and spur inflation, but of course these are not normal circumstances.

So what exactly is Carney threatening to do? Lets explore the available options.

First, an identity:

M = NFA + (NDA – NW) = NFA + DC

Where M is the domestic money supply

NFA is the central bank’s stock of net foreign assets (gold & foreign currency reserve)

NDA is the central bank’s stock of domestic assets (govt. securities, loans on commercial banks, other)

NW is net worth

DC = (NDA – NW) is the stock of domestic credit made available by the central bank

From the above identity, we see that the monetary base can be increased/decreased by adjusting either the stock of foreign assets or the stock of domestic credit. In a foreign exchange intervention, this can be accomplished one of two ways:

1. Sterilized Intervention – the Bank of Canada buys US dollar assets but offsets the effects on the domestic money supply by selling domestic assets. The effectiveness of sterilized intervention is controversial and many economists believe that it in most circumstances it is ineffective in influencing the exchange rate. If any change is expected to occur, it is through the changing composition of assets (referred to by economists who study such things as the “portfolio balance channel”)

2. Non-sterilized Intervention - the Bank of Canada sells Canadian dollar/buys US dollar assets (increase in NFA) which is not offset by the sale of domestic assets. The increase in NFA increases the domestic money supply (M) and therefore has the same impact as an open market operation.

I think we can take option #1 off the table since sterilization would have no impact on the price level, which is the Bank’s main concern.

If option 2 sounds familiar, that’s because it is essentially quantitative easing, only with an expansion in the money supply coming through an increase in NFA rather than through an increase in domestic credit, DC. Economists tend to believe that non-sterilized intervention is an effective tool for depreciating the currency.

Will the Bank of Canada finally make good on its QE threats? I think that they have talked about it so much that they have no real choice. You can only bluff for so long before you lose credibility. I would guess the trigger would be a run to parity as a result of weakening USD and consequent rise in commodity prices but I guess we will have to wait and see.

How much will the Bank have to increase the money supply to impact the exchange rate? We’ll have to leave that to another post, this one is already too long.

Friday, October 9, 2009

The Training Wheels Economy rolls on

All in all, the data released this week continues to point to a modest recovery in Q3 and an economy that would be continuing to slide if not for extraordinary government support.

Sunday, October 4, 2009

The recovery is not off to a good start

We should get a better idea of the shape of the recovery this week with data for Q3 housing starts, building permits, jobs, and the increasingly important BoC Senior Loan offers Survey all being released in the next few days.

My own forecast for Q3 growth is still somewhere around 1-1.5%. Consensus from Bay Street seems to be around 2-2.5%, though I notice that BMO has, again (aside: I think BMO revises every week, it's really something) revised their forecast to 1.3%.

Tuesday, September 15, 2009

TSX hits my target! Now what?

In my previous post I suggested that the market was undervalued and would be pricing in 2009 TSX earnings of about $575 per share. I then applied a long-run average PE multiple of about 20 to arrive at my call of 11,400-11,500.

Current estimates for 2010 corporate profits are in a range of 5-10% growth. My own model of corporate profits is spitting out growth of 30% (which I don't quite believe) - so lets say TSX EPS of around $630-$750. Since so much depends on the multiple applied to these profits, i've made a quick and dirty attempt at incorporating a PE equation based on short and long-term interest rates and nominal GDP growth into my Canadian economy model. The model derived PE suggests an average multiple of between 17-18 over the next year. Applying this multiple to the above range of forward earnings gives a fair value for the TSX of between 11,400 and 13,500, suggesting a market going sideways or a market about to pop by about 20%. A big range to be sure, but perhaps that is consistent with the amount of uncertainty in stock prices.

Could I have arrived at this range by pulling numbers randomly out of a hat? Probably, but what fun would that be?

Monday, September 7, 2009

The Training Wheels Economy

For its part, the Bank of Canada has committed to keeping its target rate at an effective lower bound of 25bps until the second quarter of 2010. The fiscal stimulus proposed by the Federal Government is projected by the Bank of Canada to contribute about 2.3% to GDP over the next year and a half, including close to half of the Bank’s projected growth for 2010.

So how long might the economy need training wheels? Well, personal consumption and residential investment seem to have turned, which is normally the case at the end of a recession. However, if this recession is anything like the past, private sector investment in non-residential structures and machinery and equipment may not recover for a while, particularly if bank lending remains tight.

Non-residential investment in structures and M&E contributed an average of about 1% to annual real GDP growth from 2003-2007 before subtracting growth in 2008 and 2009. The fiscal stimulus should go a long way in replacing that growth in 2010, but if consumption growth stalls or the loonie creates a larger than expected drag on exports, we could be looking at keeping the training wheels on for an extended period. If not, a 1980-1982 style double-dip recession is a real possibility.

Monday, August 31, 2009

Hey I got one right! .......but so did everyone else.

For whatever reason there was quite a bit of (correct) consensus on the growth prospects for the 2nd quarter:

Actual: - 3.4

WCI (Stephen Gordon): -3.4%

BoC: -3.5

SMC (Me): -3.5

BMO: -3.3

RBC: -3.2

CIBC: -3.1

TD: -2.2

Scotia: -2.0

The one thing the above list ignores is vintage (which I'm too lazy to dig up right now). The last time I made a forecast was sometime in early July, while others like RBC and TD were mid-June.

Congrats to Stephen Gordon for nailing the number right on the head (I know yours was more of a preliminary estimate based on available 2nd quarter data, but still, kudos.)

Wednesday, August 19, 2009

WTF Econo-Journalism: CBC Edition

"Another sign that the economy is on the road to recovery - inflation in

July fell to its lowest level in years"

I've asked this before, and I'll keep asking, are there any editors anymore? I assume someone wrote the above for the teleprompter and someone else signed off on it. And yet, there is some blonde news anchor on my TV making an elementary mistake while projecting absolute confidence, leaving me no recourse but to scream obscenities at the ceiling.

Sunday, August 16, 2009

Reconciling the Bank of Canada's forecast or the Importance of Exchange Rate Assumptions

Bank of Canada 3%

Merrill Lynch 2.7%

Bank of Nova Scotia 2.5%

Royal Bank of Canada 2.5%

Shock Minus Control 2.5%

Bank of Montreal 1.8%

CIBC 1.5%

Toronto-Dominion Bank 1.4%

One probable reason for the variance between my forecast and the Bank’s is the Bank's assumption of an 87 cent US/CAD exchange rate versus my model range of 87 to 95 cents. Indeed, I can account for quite a bit of the variance between my own forecast and the Bank's simply by tweaking the exchange rate assumption.

Saturday, August 8, 2009

Canadian Economic Forecast 2009-2010

I expect the unemployment rate to peak around 9.2% before declining at a measured pace as the economy begins a slow recovery. The enormous amount of slack in the economy should keep core inflation well below the Bank of Canada’s 2% target for all of 2009 and 2010. Low inflation, along with a strong Canadian dollar, will allow the Bank of Canada to keep its conditional promise of holding its overnight rate at 25bps until the second quarter of 2010. However, if core inflation remains near target, the Bank may be eager to bring rates back to pre-crisis levels. The forecast suggest that the second half of 2010 could see the Bank increasing its overnight target by 100 basis points with the first increases announced in June or July.

I should note that this forecast assumes that the normalization of credit markets currently underway continues without further disruption and that GDP growth in the United States turns positive by the end of 2009 and remains positive but below trend growth in 2010. The forecast also assumes that the Canadian dollar stays within a range of 87-95 cents.

Wednesday, July 29, 2009

The recession is over!!...now about that recovery...

The 1981 recession was a classic “V” shaped recession and lasted roughly five quarters. It was also the second part of a double-dip recession, following a brief contraction in 1980. The recession of 1990 was a steep, extremely painful and protracted “U/L” shaped recession, and was followed by a very weak recovery.

The Bank of Canada made some noise this past week after the release of its latest Monetary Policy Report (MPR) predicting an end to the recession in Q3 of this year. If the Bank’s forecast is correct (remember that it is a forecast, not an official statistical release) then the 2008 recession would go into the books as the shortest of the past three Canadian recessions.

The following figure illustrates the path of the Canadian economy 12 quarters after the business cycle peak prior to the recession for 1981 and 1990 along with the recent Bank of Canada forecast.

So where does the BoC expect the recovery to come from? Three places – Personal Consumption Expenditures, Government and Inventories. See below from the July MPR

I have my doubts that PCE will really be that strong coming out of this recession. THe unemployment rate is liklely to approach 10% and household saving is rising in response to massive wealth destruction from falling equity and home prices over the past year. However, indicators such as retail sales and consumer confidence do seem to be improving, so perhaps the Bank is right.

The real difference maker in the expected recovery from the 2008 recession, compared with past recessions, is the fiscal policy response of the Canadian Government. Government spending in the year following the end of the 1981 recession contributed just 0.3% to real GDP growth and only 0.2% to real GDP growth in the year following the end of the 1990 recession. In contrast, the BoC estimates that Government spending will add 1.3% to growth in 2010.

Given that inventory rebuild is estimated by the Bank to add 1% to growth in 2010 and you have 2.3% of the 3% growth forecast estimated to come from temporary sources that may not do much for job creation. Add an uncertain outlook for the Canadian housing and non-residential construction sector and it would seem like we have a recipe for a jobless recovery in 2010. But at least the recession is over...right?

Thursday, July 16, 2009

Thursday, July 2, 2009

Baby Induced Blogging Hiatus

Wednesday, June 24, 2009

The Canadian Dollar Response to an Oil Shock

This finding shouldn’t be a surprise to even casual observers of commodity and currency markets. The loonie has followed oil in virtual lockstep for many years, hitting 1.10 to the US dollar as oil rocketed past $100/barrel.

To me, it is not immediatley clear why rising oil prices should impact the loonie. Oil is traded in US dollars and so higher Canadian oil exports shouldn't impact the Canadian dollar since the sale of oil does not create additional demand for Canadian currency. However, higher oil prices do create demand for Canadian dollars for the purpose of FDI – international oil companies developing projects in the oil sands do need to pay for assets, labour, etc in local currency. The oil-price break-even rate on these projects is high and so investment is driven by price. Therefore, oil impacts the loonie through the capital account, rather than the current account. (at least that is my take, if I’m wrong, please feel free to tell me so).

I use a version of the Issa, Lafrance, Murray model that, as shown in the dynamic simulation below, tends to track the Canadian dollar fairly closely.

The graph below sets out the baseline scenario for oil prices, based on EIA forecasts, and a somewhat arbitrary path for a hypothetical oil shock that would have the USD price of oil rise to $130 by the third quarter of 2010.

(1)_31540_image001.gif) If the future path of oil prices looks more like the green line than the EIA forecast above, then, from the model, we should expect to see Canadian dollar back to parity early next year.

If the future path of oil prices looks more like the green line than the EIA forecast above, then, from the model, we should expect to see Canadian dollar back to parity early next year.(1)_10155_image002.gif) Rising oil prices may get the loonie near parity, even without a steep run-up in prices, particularly if accompanied by weakness in the US dollar. But if oil really starts to run, I think it is very likely that the loonie will approach, or possibly surpass, its previous highs.

Rising oil prices may get the loonie near parity, even without a steep run-up in prices, particularly if accompanied by weakness in the US dollar. But if oil really starts to run, I think it is very likely that the loonie will approach, or possibly surpass, its previous highs. Monday, June 22, 2009

Wednesday, June 10, 2009

Whats going on with the yield curve part 2: Does a steepening of slope imply growth?

The forecast implications are significant. Ignoring the signal from the yield curve implies a less robust recovery while accepting it provides a recovery akin to what the Bank of Canada forecast in its last MPR. The figure below illustrates the incremental growth implied by the yield curve shock (versus a control baseline of ignoring the signal, eg, running a simulation in which no steepening occurred

I'm leaning towards interpreting the movement in the yield curve as simply the normalization of inflation expectations and the impact of the "flight from quality" as investors regain confidence. Anyone want to try to convince me otherwise?

I'm leaning towards interpreting the movement in the yield curve as simply the normalization of inflation expectations and the impact of the "flight from quality" as investors regain confidence. Anyone want to try to convince me otherwise?

Tuesday, June 9, 2009

What's going on with the yield curve?

Proponents of this view point to the recent increase in the slope of the government yield curve as a clear signal that purchasers of government treasuries, fearful of the impact of massive monetary and fiscal stimulus, are ratcheting up their inflation expectations and demanding a higher yield on long-term debt. Still others view the steepening yield curve as a positive signal of expected future growth and the end of the recession. So which is it?

Looking at inflation expectations derived from Canadian real-return bonds, it is pretty difficult to conclude that Canadians, or buyers of Canadian debt, expect runaway inflation on the horizon. Inflation expectations seem to have ticked up recently, but I think only because a Great Depression II induced deflationary spiral seems to be off the table. Moreover, expectations remain firmly anchored in the BoC comfort range

It is also hard to conceive of a scenario in which inflation could get out of control while the economy is operating so far below its potential.

_8303_image001.gif)

My own opinion is that the increase in the slope of the yield curve is a function of the following factors (in no particular order):

1) Flight from quality – investors getting out of treasuries and back into riskier assets

2) Normalized inflation expectations – fears of a deflationary spiral seems to have been successfully beaten back by the Bank of Canada

3) Expected Government borrowing due to larger than anticipated fiscal deficits

4) Expectations that the worst of the recession is over and the economy will return to positive growth soon.

Monday, June 1, 2009

GDP better than expected in Q1

I haven't had time to delve into the details, but much of the surprise seems to have come from higher than expected consumer spending. Personal consumption expenditures were actually less of a drag on growth in Q12009 than in Q42008. Investment was atrocious, as expected and growth was helped out a little by imports falling more than exports.

Wednesday, May 27, 2009

Stephen Gordon reminds us not to read the National Post

As usual when an out of his depth journalist makes a stupid economic argument, Stephen Gordon pounces.

Thursday, May 21, 2009

Batttle of SFU Economists

Read skeptic David Andolfatto here: http://andolfatto.blogspot.com/

and stimulus proponents James Dean and Richard Lipsey here: http://blogs.ft.com/economistsforum/2009/05/will-stimulus-spending-stifle-recovery/

Tuesday, May 19, 2009

Minsky and Haircuts

For example, Bank A wants to raise cash and pledges an asset worth $100 as collateral. Bank B takes the asset and gives Bank A $98 in cash. The $2 difference is the haircut and depends on the credit risk of the counterparty.

Here is where Hiram Minsky enters the picture - look at the graph below from Gorton's paper:

Klein makes the point that it is not the spike in haircuts demanded that is troubling, it is the period of extremely low haircuts just prior to the crisis. Minsky warned that such periods of calm betray extreme underestimation, and hence underpricing, of risk that eventually leads to crisis, asset fire-sales and flight to quality - a scenario that Paul McCulley of PIMCO termed a "Minsky Moment". A smaller scale example of a Minsky Moment is the collapse of the hedge fund LTCM in 1998. Followers of that story may recall that LTCM convinced its counterparties to allow them to borrow without taking a haircut on collateral. We all know how that ended.

I haven't seen any research exploiting the potential predictive information in haircuts, credit spreads, etc in detecting a rising probability of these Minsky Moments. Given the recent rediscovery and surging popularity of Minsky (I certainly had never heard his name in all my years studying economics) perhaps some enterprising economist is already working on it.

Wednesday, May 13, 2009

SMC call causes TSX to tank!

Monday, May 11, 2009

Is the TSX Fairly Valued?

A common methodology used to make broad stock market calls involves assigning a multiple to a forward estimate of TSX earnings. TSX composite earnings as of December 2008 were about $830 and the forecast range for corporate earnings for 2009 is a decline of between 15%-31%, suggesting a 12 month forward estimate for 2009 of between $575-$699. The former seems much more likely to me.

What is the right multiple? Hard to say. Earnings multiples tend to get compressed in recessions before increasing as the economy recovers and investors regain confidence in equities. The TSX is currently trading at around 12x current earnings, which is similar to multiples observed in the beginnings of previous recessions.

The average TSX P/E ratio since 1956 is about 20x. Applying this long-run average P/E to the range of forward earnings estimates gives a market valuation at the end of 2009 of between 11,484 and 13,980 which implies that the market is currently between 11% and 27% undervalued.

I'm more sympathetic to the low-end of the corporate earnings forecasts so i'll conclude with a market call of 11,400-11,500 by the end of 2009.

Monday, May 4, 2009

What can we learn from past recession-recovery cycles?

To test the plucking theory with Canadian data I have plotted the magnitude of Canadian recoveries in the first 4 quarters after a business cycle trough against the depth of the recession. The plot reveals no consistent pattern for economic recoveries in Canada. Indeed, leaving out the blue square representing my forecast, it would be difficult to draw a meaningful regression line though the points below.

The 1981-1982 recession fits Friedman’s plucking theory – a deep recession followed by a robust recovery. However, the 1990-1991 recession was followed by a tepid recovery while healthy recoveries followed the relatively mild recessions of 1974-1975 and 1980. Though in the latter case the recovery was quickly snuffed out by the onset of the 1981-1982 recession.

It is often said that no two recessions are alike and from the above it would seem that sentiment would apply to recoveries as well. I do find it interesting that, in contrast to the results based on US data, the depth of Canadian recession provides little insight into the magnitude of the eventual recovery. Anyone have a theory why this might be the case?

Monday, April 27, 2009

What comes after the ELB?

In its recent policy statement, the Bank of Canada took the unprecedented step of declaring a conditional commitment to keeping the overnight rate at an effective lower bound (ELB) of 25bps until June 2010. Moreover, In its accompanying Monetary Policy Report, the Bank has forecast that inflation will not return to target until the third quarter of 2011. This got me thinking – what do these two statements imply about the Bank’s strategy in moving the overnight rate off of the ELB and to some “neutral” level?

The path of short interest rates that is consistent with 2% inflation by Q3 2011 would be readily available to policymakers from running the Bank’s medium term projection model, ToTEM. I tried to elicit some indication of future policy from Pierre Duguay at a recent presentation but he quite rightly only waved his hands.

Fortunately, we don’t need to extract such information from reticent Bank of

The rule suggest that monetary policy consistent with 2% inflation would have interest rates rise 225 basis points between June 2010 and September 2011. It would be interesting to observe if there is any action in bond markets based on the BoC outlook. I'm no expert in the matter but if this analysis is reasonably accurate, there should be money to be made shorting the front end of the government yield curve next summer.

Tuesday, April 21, 2009

Carney decides to cut

More to come when the Bank releases its Monetary Policy Update on Thursday.

Monday, April 20, 2009

BoC Announcement Tomorrow

How should the BoC go about implementing a quantitative easing program? I'll outsource that part to Pimco's Ed Devlin.

Thursday, April 16, 2009

Financial Linkages and the Real Economy

I am planning to incorporate these financial linkages into my larger model, but for now I thought it would be interesting to run a quick and dirty VAR. The figure below shows the impulse response of Canadian real GDP growth to a one standard deviation lending tightness shock.

This simple VAR analysis reveals that a one standard deviation shock to the BoC senior loan officer index (about 15 points) translates to a -0.35% decline in real GDP growth after four quarters. This would indicate that current lending conditions (an index reading of about 60) will have persistent negative effect on the economy and further highlights the importance of addressing the liquidity needs of the Canadian banking system.

Sunday, April 12, 2009

Forecast update

Wednesday, April 8, 2009

Home Construction Rebounds

What didn't make the article? How about the fact that year-over-year March housing starts - a better measure than the highly volatile month-over-month - were down 36% and quarter-over-quarter starts have fallen 20%. Not exactly a rebound.

Tuesday, April 7, 2009

A Bridge to Where?

Canadian economic forecasters have recently been drastically lowering their expectations for Q1 GDP from simply a very bad quarter, say around -4% to -5%, to expecting one of the worst quarters in Canadian history. So what gives? Is incoming data really that bad? How can one reconcile current data with quarterly forecasts?

Well, it turns out that there is a fair amount of literature on updating quarterly forecasts with monthly information. One technique that caught my eye (because of its simplicity) is the construction of a so-called “bridge” equation. A bridge equation is basically a simple regression of monthly economic variables, aggregated to quarterly values and then used to forecast quarterly GDP. An example of such an equation can be found in this Bank of Canada working paper.

The model in the BoC paper includes the consumer confidence index, hours worked, retail sales, housing starts, 3-quarter lagged Canadian GDP and

So, using the bridging equation we end up at the same bad place arrived at by

Friday, April 3, 2009

50 posts-hmm...

Things I enjoy about blogging:

1) I have been out of grad school for 3 years, and I have found blogging to be a very useful way to organize thoughts and to motivate myself to keep learning. Without blogging I don't think I would have ever have had the motivation to put in the time and effort to construct a quarterly forecast model, something I've always been interested in but never found the time for.

2) Feedback - I love getting comments, not only because blogging (and maybe Canadian econoblogging in particular) can sometimes feel like an echo chamber but because they help me to refine or revise my thinking. Enormously helpful.

3) I like having a record of my thoughts, even if they don't always make sense.

Things I don't enjoy:

1) Sometimes I simply don't have anything to say, for extended periods of time. I am in constant amazement of people like Nick Rowe, Mark Thoma, Menzie Chinn/James Hamilton and others that put up insightful and detailed posts on a daily basis.

2) Blogging can be time consuming - I have a wife and two kids (1 and 3), and a demanding full time job and finding time/energy to write is not always easy.

3) Working hard on a post that I think is really interesting and then seeing a big doughnut in the comments section. A little deflating at times - then again, I probably only comment on 1/100 of the blog posts I read, so I'm not sure why anyone else would be any different.

In all, after 50 posts I'm reasonably happy with my contribution to the small world of Canadian economics blogging. My next project for the site is to build a US model and post US forecasts, perhaps as a summer project.

Thanks to all who have been reading - on to the next 50!

Saturday, March 28, 2009

Thursday, March 26, 2009

This is bad news

"Mr. Page told the House of Commons finance committee that, based on private-sector forecasts and his own assessments, he expected GDP to contract by about 8.5% in the first quarter of 2009 and by 3.5% in the second quarter." - Globe and MailI've only recently begun trying to forecast GDP and in the model that I'm using, it would be very difficult to generate a contraction of that magnitude. I would love to see the details or the rational for the PBO and Merrill forecasts .

Wednesday, March 25, 2009

BC Output Gap and the 2010 Games

This assumes that the 2010 games add about 1% to BC real GDP in 2010 and that growth returns to a trend rate of 2.7% in 2011. Now, I know there are those that are not in favour of the Games but I don't think you could ask for a better stimulus plan - it is temporary, targeted, and the timing could not be better. Even more, the stimulus is a mix of of government and private spending and is spread across diverse sectors of the economy.

This assumes that the 2010 games add about 1% to BC real GDP in 2010 and that growth returns to a trend rate of 2.7% in 2011. Now, I know there are those that are not in favour of the Games but I don't think you could ask for a better stimulus plan - it is temporary, targeted, and the timing could not be better. Even more, the stimulus is a mix of of government and private spending and is spread across diverse sectors of the economy. Whether the Games will have long-lasting impacts beyond 2010, or even if the money could have been spent better elsewhere are open questions, but as stimulus, it is hard to argue against.

Saturday, March 21, 2009

Weekend Quantitative Easing Wonkfest

So what is quantitative easing? Here are some great links that should tell you all you ever wanted to know. Enjoy!

Links:

___________________________________________________________________

Quantitative Easing - Econobrowser

Quantitative Easing Explained - Financial Times

A look at the Bank of England’s balance sheet - Macroblog

Is quantitative easing trying to raise or lower interest rates? - Worthwhile Canadian

Initiative

How should we think about the monetary transmission mechanism? - Macroblog

Quantitative Easing and the Bank of Japan - Federal Reserve Bank of San Francisco

Did Quantitative Easing by the Bank of Japan Work? -Federal Reserve Bank of San Francisco

Fiscal Aspects of Quantitative Easing (Wonkish) - Paul Krugman

____________________________________________________________________

Wednesday, March 18, 2009

Merril Lynch forecasting -9.1% GDP contraction in Q1/2009

Sunday, March 15, 2009

Forecast Update

I'll benchmark my forecasts to the pros on Bay Street once Q1 GDP is released, that should be interesting.

(click to enlarge image)

Thursday, March 12, 2009

Can a Taylor rule lead to a liquidity trap?

Maybe. Here is the story (it’s a long and extremely wonkish story, but hang in) – Start with the Euler condition and the Fisher equation from a standard money-in-utility (MIU) model:

Pt(1+ ίt)/Pt+1 = uc,t/βuc,t+1 (1)

Which can be rewritten as:

1+ ίt = (Pt+1/Pt) z (2)

Where z is assumed constant and summarizes the real factors that influence the real interest rate, r*. Taking logs of both sides,

ίt = pit+1 + ln(z) (3)

Further assume that the central bank follows a simple

ίt = r* + pi* + δ(pit – pi*) (4)

Where ίt is the nominal rate of interest and r* is the natural rate of interest. Combining (3) and (4) gives an equilibrium process for inflation that looks like:

pit+1 = pi* + δ(pit – pi*)

Finally, assume the central bank follows the so called “Taylor Principle” that the central bank reaction function should respond disproportionately, or more than one for one, to changes in inflation. Therefore, in the above equilibrium process, δ>1. Graphically, the dynamics of this equilibrium process looks like this:

Notice that the policy rule is bounded at the rate of deflation consistent with the zero nominal bound for interest rates. To see how this type of rule could lead to a liquidity trap equilibrium, observe that if inflation starts out below pi*, the stationary “good equilibrium” where inflation is equal to its target level, the central bank will cut the nominal rate in order to stimulate the economy. Under the above rule, inflation will decline leading to another rate cut, generating further expectations of lower inflation, and so on until it reaches the stable but deflationary equilibrium, pi**.

At this point you should be thinking – wait a minute, shouldn’t interest rate cuts lead to higher inflation expectations? Under normal conditions yes, but think of the above model in the present context in which inflationary expectations may have become detached from the 2% anchor and in which the economy is performing well below potential – it may be the case that rate cuts, particularly near the zero lower bound, will feed deflationary expectations. Moreover, since the only stable good equilibrium is at pi*, and because the inflation process is forward looking, the only way to get out of the deflationary equilibrium is to get expectations to jump to the good equilibrium at pi*.

I discussed how policy-makers might engineer such a jump in a previous post.

Shock Minus Control Supports an Independent Parliamentary Budget Office

Monday, March 2, 2009

Canadian Economy contracts 3.4% in Q4 2008

Ugh. Next quarter will be much worse and Q2 won't be anything to cheer about either. Hope to see some sign of recovery in Q3. Wake me up when its over.

Sunday, March 1, 2009

How to get out of a liquidity trap?

- Credible adherence to an inflation or price level target – if credible, an inflation target anchors expectations so that a bad equilibrium of unacceptably low inflation or deflation is less likely (this deserves a post of its own, but not right now).

- Assuming fiscal policy is non-Ricardian, the Government could promise to run huge fiscal deficits if inflation falls below a certain threshold.

- Central Bank open market operations in the market for long-term bonds – Goodfriend (2000) argues that such purchases could substantially increase monetary liquidity and therefore inflation expectations.

Given the above list, it would seem that

Friday, February 27, 2009

US GDP -6.2%

Thursday, February 26, 2009

The SMC Bounce?

Monday, February 23, 2009

Do editors still exist at the Globe and Mail?

After the downturn of 2009, the B.C. economy will slog through several years of low-grade misery, the economic equivalent of a lingering chest cold. The jobs market is particularly lethargic. The unemployment rate is to peak at 6.2 per cent this year, and then drifts back to down to 5.5 per cent by 2013. By itself, that muted recovery is unimpressive. Four years of economic expansion will not be enough to trim unemployment back to the 4.6-per-cent rate of 2008.- From "After the deluge, BC faces soggy economy", Feb 20, 2009

Above is a picture of the BC unemployment rate from 1990 to January 2009. I don't think anyone looking at this graph would describe 5-6% unemployment as "low-grade misery", rather it is likely pretty close to full-employment for BC. The 4.6% rate for 2008 was a product of an overheated construction sector that is now unwinding. A skilled (or even semi-skilled) editor should catch that.

Friday, February 20, 2009

This is not investment advice

Sunday, February 15, 2009

Why Canadians should be praying for the US stimulus package to work

Lets hope it works!

Wednesday, February 11, 2009

Update: Canadian Energy Export Cliffdiving in Q4

Monday, February 9, 2009

Canada in the Financial Crisis

I enjoyed this approach so much that I thought I would steal it and apply it to Canadian variables. The graphs that follow use 2007 as the base year for the financial crisis. Unfortunately, I don't have the Reinhart and Rogoff data set so the only comparison I'm able to show is with the US.

(Click to Enlarge)

The results are pretty interesting. Canadian asset prices seem to be following the same path as the United States ( my chart doesn't show it, but Canadian home prices softened in 2008 and should fall in 2009). Also, real growth is declining rapidly.

A key difference between Canada and the US, and perhaps a difference that will have meaningful implications for longer-term recovery, is that at the time the crisis hit, Canada had a much stronger budget and trade balance. Yes, public debt will grow as a result of the stimulus package and yes our trade balance is suffering as Canada's terms of trade weakens but the point is that Canada was in much better shape to withstand the crisis.

In crude terms, we could afford the crisis whereas the United States, partially because of reckless fiscal policy and partially due to a savings glut, could not and will now find it much harder to claw its way back. The lesson, and contrary to the immortal words of Dick Cheney, deficits matter.

Friday, February 6, 2009

More proof that things are really, really bad

Payroll employment showed employment fell by close to 600,000 - unemployment now stands at 7.6%. Job losses since the start of the recession in December 2007 total 3.6 million. Wow.

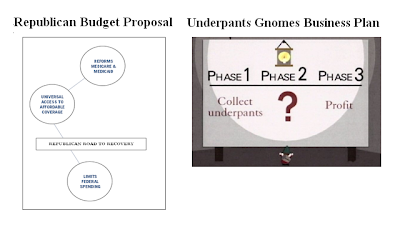

Perhaps now that strange breed of creatures known as "Republicans" will feel a little more urgency to pass the stimulus package - that is, if , you know, they can get past the bizarro land logic that "spending" is mutually exclusive with "stimulus".

Saturday, January 31, 2009

2009 Revision and 2010 Forecast

(Click to enlarge)