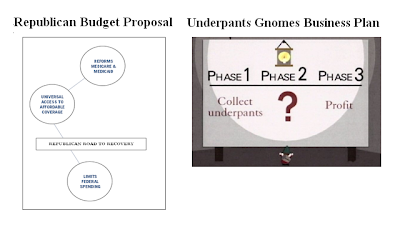

Yes, the Republican chart is real.

Yes, the Republican chart is real.

Saturday, March 28, 2009

Thursday, March 26, 2009

This is bad news

"Mr. Page told the House of Commons finance committee that, based on private-sector forecasts and his own assessments, he expected GDP to contract by about 8.5% in the first quarter of 2009 and by 3.5% in the second quarter." - Globe and MailI've only recently begun trying to forecast GDP and in the model that I'm using, it would be very difficult to generate a contraction of that magnitude. I would love to see the details or the rational for the PBO and Merrill forecasts .

Wednesday, March 25, 2009

BC Output Gap and the 2010 Games

This assumes that the 2010 games add about 1% to BC real GDP in 2010 and that growth returns to a trend rate of 2.7% in 2011. Now, I know there are those that are not in favour of the Games but I don't think you could ask for a better stimulus plan - it is temporary, targeted, and the timing could not be better. Even more, the stimulus is a mix of of government and private spending and is spread across diverse sectors of the economy.

This assumes that the 2010 games add about 1% to BC real GDP in 2010 and that growth returns to a trend rate of 2.7% in 2011. Now, I know there are those that are not in favour of the Games but I don't think you could ask for a better stimulus plan - it is temporary, targeted, and the timing could not be better. Even more, the stimulus is a mix of of government and private spending and is spread across diverse sectors of the economy. Whether the Games will have long-lasting impacts beyond 2010, or even if the money could have been spent better elsewhere are open questions, but as stimulus, it is hard to argue against.

Saturday, March 21, 2009

Weekend Quantitative Easing Wonkfest

So what is quantitative easing? Here are some great links that should tell you all you ever wanted to know. Enjoy!

Links:

___________________________________________________________________

Quantitative Easing - Econobrowser

Quantitative Easing Explained - Financial Times

A look at the Bank of England’s balance sheet - Macroblog

Is quantitative easing trying to raise or lower interest rates? - Worthwhile Canadian

Initiative

How should we think about the monetary transmission mechanism? - Macroblog

Quantitative Easing and the Bank of Japan - Federal Reserve Bank of San Francisco

Did Quantitative Easing by the Bank of Japan Work? -Federal Reserve Bank of San Francisco

Fiscal Aspects of Quantitative Easing (Wonkish) - Paul Krugman

____________________________________________________________________

Wednesday, March 18, 2009

Merril Lynch forecasting -9.1% GDP contraction in Q1/2009

Sunday, March 15, 2009

Forecast Update

I'll benchmark my forecasts to the pros on Bay Street once Q1 GDP is released, that should be interesting.

(click to enlarge image)

Thursday, March 12, 2009

Can a Taylor rule lead to a liquidity trap?

Maybe. Here is the story (it’s a long and extremely wonkish story, but hang in) – Start with the Euler condition and the Fisher equation from a standard money-in-utility (MIU) model:

Pt(1+ ίt)/Pt+1 = uc,t/βuc,t+1 (1)

Which can be rewritten as:

1+ ίt = (Pt+1/Pt) z (2)

Where z is assumed constant and summarizes the real factors that influence the real interest rate, r*. Taking logs of both sides,

ίt = pit+1 + ln(z) (3)

Further assume that the central bank follows a simple

ίt = r* + pi* + δ(pit – pi*) (4)

Where ίt is the nominal rate of interest and r* is the natural rate of interest. Combining (3) and (4) gives an equilibrium process for inflation that looks like:

pit+1 = pi* + δ(pit – pi*)

Finally, assume the central bank follows the so called “Taylor Principle” that the central bank reaction function should respond disproportionately, or more than one for one, to changes in inflation. Therefore, in the above equilibrium process, δ>1. Graphically, the dynamics of this equilibrium process looks like this:

Notice that the policy rule is bounded at the rate of deflation consistent with the zero nominal bound for interest rates. To see how this type of rule could lead to a liquidity trap equilibrium, observe that if inflation starts out below pi*, the stationary “good equilibrium” where inflation is equal to its target level, the central bank will cut the nominal rate in order to stimulate the economy. Under the above rule, inflation will decline leading to another rate cut, generating further expectations of lower inflation, and so on until it reaches the stable but deflationary equilibrium, pi**.

At this point you should be thinking – wait a minute, shouldn’t interest rate cuts lead to higher inflation expectations? Under normal conditions yes, but think of the above model in the present context in which inflationary expectations may have become detached from the 2% anchor and in which the economy is performing well below potential – it may be the case that rate cuts, particularly near the zero lower bound, will feed deflationary expectations. Moreover, since the only stable good equilibrium is at pi*, and because the inflation process is forward looking, the only way to get out of the deflationary equilibrium is to get expectations to jump to the good equilibrium at pi*.

I discussed how policy-makers might engineer such a jump in a previous post.

Shock Minus Control Supports an Independent Parliamentary Budget Office

Monday, March 2, 2009

Canadian Economy contracts 3.4% in Q4 2008

Ugh. Next quarter will be much worse and Q2 won't be anything to cheer about either. Hope to see some sign of recovery in Q3. Wake me up when its over.

Sunday, March 1, 2009

How to get out of a liquidity trap?

- Credible adherence to an inflation or price level target – if credible, an inflation target anchors expectations so that a bad equilibrium of unacceptably low inflation or deflation is less likely (this deserves a post of its own, but not right now).

- Assuming fiscal policy is non-Ricardian, the Government could promise to run huge fiscal deficits if inflation falls below a certain threshold.

- Central Bank open market operations in the market for long-term bonds – Goodfriend (2000) argues that such purchases could substantially increase monetary liquidity and therefore inflation expectations.

Given the above list, it would seem that